Recent Stories

4/9/10: Some of the most interesting tidbits about how Chase does business often come from court cases, like this one. In summary, Chase had a deal with a refund finance company to provide funds to finance tax refunds. They apparently wanted to end the relationship so they not only said no to future business, but also refused to honor any checks that had already been written but not cashed. That's just mean! Chase asked the court to deny the suit or alternately to move it to a more favorable venue. They were denied on both counts.

4/9/10: A few days ago we reported that Chase has increased its bonus for opening a personal checking account to $150, and theorized that perhaps they needed to do so to get new customers because of too many defections. Well, now they have apparently increased their bonus for opening a business checking account too, to $200.

4/9/10: What a great idea. Send a letter to Chase every month asking them to prove that you owe them the money they claim you do on your mortgage, HELOC, or credit card. So many of these loans are sold and Chase just processes them, quite often banks have a hard time proving that they actually own the loan in court.

4/8/10: Whether or not you owned stock in Washington Mutual before it was seized, the fact that more of the parties inolved in the Washington Mutual bankruptcy (now the bondholders) opposing the proposed bankruptcy plan, that gives JP Morgan Chase billions on WaMu's tax credits, is a good thing.

4/6/10: Oops, they did it again. Chase has once again told a homeowner to stop making payments so they will qualify for a loan modification and then foreclosed upon them while this was happening wihtout telling them.

4/6/10: Uh oh. Looks like Chase made the list of worst abusers of junk mail. Please join the campaign to ask them to stop sending out so much junk.

4/5/10: If you are mad a Chase bank, there are MUCH better ways to deal with it than calling in a bomb threat.

4/4/10: Another complaint of Chase's bad customer service that pretty well spells it out: Rudeness, talked down to, and different answers from different people.

4/4/10: If you are being foreclosed upon, this article should be very interesting to you. It seems that major provider of documents that banks use in court to prove they own your loan is being investigated for providing inaccurate documents. Basically, it seems that with all the slicing and dicing of mortgages, banks may not actually be able to prove they own your loan and have the right to foreclose upon it. Several foreclosure actions have been dismissed because of this.

4/4/10: WaMu LIVES!!! Perhaps a little overly dramatic, but there appears to be a chance that Washington Mutuals holding company may actually exit bankruptcy as a going concern, or as this article puts it, "reorganize around an investment subsidiary and a mortgage reinsurer."

4/2/10: This is truly amazing. Over the course of seven years, a Chase credit card customers personal assistant embezzled over $1 million by taking $200 to $700 cash advances from the creidt card, usually twice a day for the ENTIRE 7 year period. Shame on the card owner for not checking his account once in that seven year period, but what kind of fraud controls does Chase have exactly that won't catch fraud THAT obvious.

4/2/10: Chase has upped its bonus for opening a checking account from $100 to $150. Why would they do this? Are they losing too many customers?

3/29/10: Chase's online banking alerts that tell you when your funds get below a certain amount doesn't seem to work properly for everyone. For instance, this guy got alerts when funds were plentiful, and didn't get them when they were low, resulting in 10 overdraft fees.

3/28/10: Now the FDIC is backing away from its support of JP Morgan Chase getting part of the tax break that really belongs to WaMu's former holding company. This doesn't help WaMu's common shareholders though, as even with an additional $1.4 billion, there isn't nearly enough money to make the bondholders whole, and that happens before shareholders get any money.

3/27/10: Here is another story that outlines everything that is wrong with Chase. Homeowner applies for a modification numerous times over 9 months. Chase loses paperwork, sends paperwork to the wrong address, approves them for a program they repeatedly tell Chase they don't qualify for, and is abusive on the phone. They won't accept mortgage payments for 9 months and then demand a huge baloon payment or they will foreclose. Can Chase really be that inept, or is this an explicit strategy they are practicing?

3/26/10: Oops. JP Morgan Chase has been listed as a co-conspirator in a bond bid rigging scheme.

3/26/10: When an organization like Chase has a very good reason to fix a very public problem, and they can't, that is a clear indication that their organization is incapable. For instance, a woman sold her home and closed out her Chase mortgage, but they started harrassing her about tens of missed mortgage payments. She contacted the Chicago Tribune consumer help columnist, a story was written about the incident, and Chase responded and said they would fix the problem, a problem with which she had been getting nowhere. But they didn't fix the problem and the calls started again.

3/25/10: According to this article, Chase is the only major mortgage servicer to not offer principal forgiveness.

3/25/10: This customer's experience ALONE would be enough for me to dump my Chase Visa card. Seems he purchased something for over $3,000 and never received it. When he tried to dispute the charge through Chase, they denied the dispute because they couldn't contact the merchant that made the charge. Huh? Getting robbed by a fly-by-night outfit that disappear is EXACTLY what your ability to dispute charges on your credit card is supposed to protect you from. The final denial happened after nearly illiterate letters from Chase, and a serious runaround that makes you wonder if anyone there knows what they are doing.

3/24/10: Ok Chase, so you frequently choose to place a 7-10 day hold on check deposits. Fine. But a cashiers check? Seriously? Isn't that supposed to be like cash?

3/24/10: From a chase-sucks.com post: "Chase advertises that they loaned $50 Million to small businesses in New York ( New York Times full page ad, February, 2010). Jamie Dimon took home close to 1/2 that amount as take home pay last year."

3/24/10: Wow, Chase claims that 2/3 of the mortgages it inherited (read, stole) from WaMu are deemed impaired in some way or another. In this same article is the news that Chase is eliminating more WaMu jobs, mainly in, get this, call centers, mortgage processing centers, and back-office units. Sounds like you can expect customers service to get EVEN worse.

3/22/10: Would Chase delay the closing of a customers account to be able to charge one more monthly service fee? This customer thinks so.

3/22/10: As soon as WaMu was bought by Chase, one customers mortgage problems started, such as, unable to go into a local branch to pay the mortgage, can't pay with an electronic payment, can't go to Chase's website to pay the mortgage, frequent failure to send the monthly mortgage bill/statement, longer payment processing time leading to late payments, lost payments ... I could go on, or you could read the whole story yourself.

3/21/10: I had to laugh at this latest loan modification story. Chase would take so long to process their paperwork (the times they didn't lose it) and then come to the conclusion that the paperwork was too old and needed to be resubmitted.

3/21/10: What's worse than overdraft protection, where you buy a latte and your account goes $2 into the negative and you get assessed a $35 fee? How about Chase charging you the same fee for rejecting payments on an account with no money that they won't let you close?

3/21/10: If you screw up, it takes Chase seconds to debit your account an overdraft fee. If they screw up and take out not one but two mortgage payments, it takes at lot of calls, faxed paperwork, and 7-10 days for you to get your money back.

3/21/10: Read this if you want to read about JP Morgan Chase CEO Jamie Dimon whine about how banks are being treated unfairly by Washington. Given the fact that large banks are raking it in due to a favorable financing position created for them by low interest rates (aka created by Washington), I have little sympathy.

3/21/10: Interesting. This article in the Seattle Times seems to indicate that the Washington Mutual logo and name actually belong to the former holding company, not Chase.

3/20/10: As expected, WaMu shareholders have filed an objection to the Chase/FDIC settlement, basically because they get nothing from it. My concern is that the settlement helps sweep this whole event under the rug and the shenanigans that caused so much pain for WaMu customers and shareholders does not get fully investigated. If you have been affected by the WaMu seizure, I urge you to contact your representatives to ask them to support the investigation in to the WaMu seizure.

3/20/10: Thinking of trying to short-sell your property with a Chase mortgage, yea, don't bother.

More stories (amuse yourself for hours!)

Helpful Information

(new) Here is another Chase contact to try to ask for help when you can't find anyone else to help you:

Mr. Frank Bisignano

Chief Administrative Officer

JPMorgan Chase & Co.

270 Park Avenue

New York, NY 10017-2014

Ah, immortality. This site recently reached the first page for Google searches on "chase sucks."

Having a problem with the banking side of Chase? Here is a contact to try:

Heather Joyner

Executive Specialist

800.242.7399 ext. 51279

713-262-1279 Direct Line

FAX: 281-915-0984

heather.joyner@chase.com

Having a problem with Chase? Email Chase's CEO Jamie Dimon for help at jamie.dimon@jpmchase.com or try executive.office@chase.com or send him snail mail at:

James Dimon

Chairman and Chief Executive Officer

JP Morgan Chase

270 Park Avenue, 39th Floor

New York, NY 10017

The transition to Chase was supposed to be complete by October for former WaMu branches. The WaMu website goes straight to Chase now. Is your branch completely Chase? Are all of your accounts accessible from Chase.com? Can you fulfil all of your banking functions at a Chase branch? Let us know.

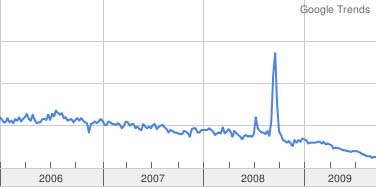

As this graph from Google Trends for the search term "washington mutual" shows, WaMu was in trouble long before the crisis of 2008.

ALERT: Don't fall for scammers fake Chase texts to your cell phone telling you your account is suspended. If you received one of these, call the number YOU KNOW is for Chase Bank, not the one in the text message.

Here is a link to lots of contact information for Chase.

Here is a number supposedly for the Chase Executive Team, whatever that is: 800-242-7339

Numbers for Chase executive customer service:

713-262-3866 (Banking, Michelle Crabtree)

800-242-7399 (Banking, General number)

888-622-7547 x 4350

(Credit card, general)

888-622-7547 x 6833 (Credit card, Jessica)

888-622-7547 x 6164 (Credit card, Sharon)

888-622-7547 x 6838 (Credit card, Patrick)

Direct numbers for WaMu loss mitigation (if you are behind on your mortgage and need help). We haven't verified these numbers

(866) 926-8937

(888) 453-3102

(800) 478-0036

(800) 254-3677

Thanks Consumerist! (link and link)

Sme of the new rules as part of the Credit Card Act of 2009 are now in effect (8/20/09): Banks must mail statements at least 21 days before their due dates and must give you at least 45 days notice before any significant changes to rates or fees. (WSJ article)

Here is a handy guide to the Chase phone tree to get to where you want quicker.

Frustrated WaMu customer Alan tells gave me this number to get directly to a live person at WaMu without any prompts: 866-394-4034. He also designed WaMu a new logo:

IMPORTANT TIP: CALL WAMU/CHASE TODAY AND TURN OFF OVERDRAFT PROTECTION. This scam of a service will allow debit card purchase to go through when there isn't enough money in your account, and rack up tons of overdraft fees at $35 a pop. WaMu/Chase claims this is a benefit and it is enabled on all new accounts!

If you want to record your phone conversations with WaMu/Chase, read this.

7/31/09: The traffic says it all. The large bar below was Sept 08 when WaMu was siezed and lots of people were wondering WTF. Since then, after interest substantially waned, site traffic has steadily increased. Translation: lots of people (about 5,500 visits in July 09) are looking for information on why WaMu/Chase sucks so much, perhaps because they are sucking more and more.

FindABetterBank.com helps you, well, find a better bank.

The Federal Reserve regulates Chase Bank which owns WaMu. To file a complaint with the Fed, go here.

Other resources for WaMu-Chase customers:

www.chase-sucks.com

www.chasebanksucks.com

http://consumerist.com/search/chase/

http://chasehomefinancesucks.com/

http://thecatwhoatechasebank.blogspot.com

Thanks to everyone that linked to this site. We are ranked #1 in Google for "washington mutual sucks" and "wamu sucks", and are now on the first page for "wamu"! (more Google tricks here)

I created this complaint site because WaMu frustrated me and I wanted to do something about it. I've also created websites to share information on other things that frustrated me:

Direct mail: NoDirectMail.org

Gift cards: Gift Card Advocate

Sleazy official looking notices: Annual Review Board

If you think something is unfair, I urge you to do something about it! If we all did this, people and companies would behave better!

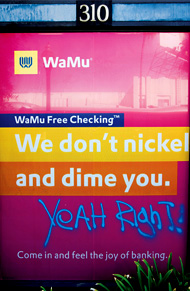

This picture, shown in a Business Week article, is graphiti painted on a WaMu branch.

Banks are Pissed, Not Fun Anymore (7/12/09)

There is no question in my mind, banks are pissed at regulators and customers for throwing a wrench into their profit making machines, and they are taking it out on us. If you've seen the secret history of the credit card, you know that the banking and credit card industry engineered their profit machine by setting people up to fail with things like higher credit than they deserved, monthly payments that were far too low, racheting up interest rates for any (and often no) reason, and automatic overdraft protection that generates tons of overdraft fees. Now the government has tightened regulations through the Feds new rules and the Credit Card Reform Act of 2009 which outlaws many of these practices and they are further discussing the overdraft issue, and consumers are defaulting at record rates.

Banks are pissed as the era of easy money is quickly fading into history. I recently received a notice form Bank of America that my account was switching from a fixed rate of 9.9% fo a variable rate that is also currently 9.9%. Sounds the same but this is also a trick, as the prime rate the variable rate is based on is historically low at 3.25%, meaning that my rate will average much higher over the next decade. They are doing this to me, a good customer, with perfect credit, a perfect payment history, and I use my credit cards a lot. They claim they are doing this to all their accounts.

Perhaps it is time to start paying for things with cash again. Merchants will thank you, as it saves them 3%. For businesses like a grocery store, which has net margins of about 1%, this can make a HUGE difference.

Banks need to be taught a lesson, the time of easy money and abusing customers is gone. It is time they started behaving like the revered institutions they once were again.

Why credit cards are a problem at ALL banks (4/23/09)

As evidenced by many recent headlines as well as this Marketplace story, all banks seem to be trying to squeeze as much money from their credit card customers to make up for rising delinquencies. Excuses for raising rates to sky-high levels are getting pretty thin and hard to believe. Getting your rates jacked up to 30% because you were late on one payment even for good reason is commonplace and most credit card companies are guilty of other sleazy practices, such as applying payments to the lowest interest rate debt (even if it is the newest) and applying interest to already paid balances.

President Obama is meeting with credit card executives today to try and convince them to become more reasonable lest they get new regulation shoved down their throats by Congress. The Federal Reserve has already instituted new rules back in December 2008, which covers banks regulsted by them. These rules don't take effect until July 2010. At this point, relief seems certain, but it will take a year or more to take effect.

Even if regulation does fix some of the problems, new rules may not apply to what banks have already done and banks will probably figure out new and creative ways to ding customers. Consumers must learn to be as active as possible in dealing with fee agressive banks.

If you feel that you have been treated unfairly, I urge you to contact your bank and ask them to be more reasonable. If the person you are talking says they can't do anything, ask for a manager. If the manager won't do anything, ask for their manager. If they won't transfer you to a manager, call back and try again. Contact the company's customer satisfaction department. File a complaint with the BBB, your states department of consumer affairs, or the organization that regulates your bank. Write letters in addition to calling them on the phone. Find online venues where you can post your complaints. Set up your own complaint website like I did. Write your congressperson. Read your bill and make sure it is correct. Read the fine print on your credit card agreement and see if you can find where they are breaking it.

The more that people refuse to be taken advantage of the less leeway it gives organizations to take advantage of us.

Chase turns back the clock on WaMu branches (4/7/09)

As reported in the WSJ (WaMu's Branches Lose Their Smiles 4/7/09) Chase is ripping out all of WaMu's "customer friendly" branch designs and replacing them with a traditional teller window (with bullet-proof glass) configuration.

I find it interesting that anything about WaMu would be considered customer friendly, as they have had a reputation for poor customer service (including a BBB 'F' rating), which has only intensified since the crisis began for them in the middle of last year.

I personally bank at First Republic Bank, which has a very non-traditional branch setup; their branches consist entirely of personal bankers sitting at desks. You develop a relationship with a personal banker (although anyone in a branch will help you) rather than the next-in-line mentality. It is also nice to have my bankers email address, so I can deal with some things without going into the branch or phoning and have access to someone who knows me personally. On the rare occasion when I overdraft (before I had an overdraft protection credit line) someone from the bank would call personally to let us know there was a problem.

Other banks seem to go out of their way to NOT use all the contact information they have for you when there is a problem. Countrywide did this when I accidentally missed a mortgage payment when on vacaction (forgot to pay it before we left). They left 9 automated messages on our home number but never once tried to contact me using other information they readily had - my mobile number and email address. Banks like WaMu, Chase, and others have become too dependent on fees and don't seem to want to jeopardize the fee stream by making things easier.

But I digress.

It sounds like WaMu's "radical" branch configurations were mostly cosmetic, not a redesign of how business is done. It seems to be coming more clear that Chase is more interested in moving backwards with WaMu than forwards. Too bad.

WaMu tries to dismiss a class action (2/4/09)

With all the information flowing around about the out and out fraud practiced by WaMu in their culture of deceit trying to sell as many crappy home loans as posible, I find it funny that WaMu claims in response to a class action filed against them that they are not liable just because they "failed to predict the severity of the housing crash and the impact it would have on WaMu." Oh please. That is like saying that builders of houses of cards can't be blamed for failing to predict a slight breeze. The problems with WaMu started at the top and the former executives and directors personal gains from WaMu should be fair game for those who lost money.

Update 4/7/09: The courts today halted a class-action lawsuit started back in 2005 against Washington Mutual on the grounds that claims against the bank are better directed to the FDIC as the receiver of WaMu since it was seized last year. (article) Is the mortgage-fraud related class-action discussed here next to be halted?

WaMu name to be distant memory (1/13/09)

Apparently Chase is starting its rebranding of WaMu branches in California in March 09, spending $300 million on the effort. They will no doubt be spending a bundle more to rebrand the rest of the WaMu branches in the US which they say will be done by 2009.

Did anyone see the Apple commercial that insinuated Microsoft was spending a LOT of money on advertising and a little money on fixing Vista?

Hey Chase, how about spending some of that money on fixing the WaMu customer service?????

This recent story of a WaMu customer trying desperately to work out a deal to be able to pay off their credit card debt despite losing their job and difficult financial times begs a serious question: are the high credit card rates themselves making their customers unable to pay the debt? I recall an interesting article from 2007 about a credit union in Florida that offered the same low mortgage rates to its prime and subprime borrowers and their was virtually no difference in default rates between the two - they were both low. Is it possible that it is the jacking up of interest rates and the unwillingness to make reasonable deals with customers in trouble that is causing customers to default on their debt, not other factors like the losing of jobs? Do credit card issuers really think that jacking someone's rates up to 28.8% is going to allow them to recover more money than giving them a reasonable rate like 10% and allowing them to pay it off?

Perhaps the credit card issuers like WaMu should consider lowering rates to more reasonable levels to stave off the tidal wave of bad debt coming their way. I think they banking industry's theory that higher rates for riskier customers protects them against the higher risk is a flawed one.

Just my opinion.

Editorial (9/26/08)

Washington Mutual, it seems, has done everything wrong. My criticism of them started out a few years ago about their poor customer service. In the last year, as their exposure to the subprime lending debacle has come to light, the bank has suffered considerably in their ability to keep going as an independent bank, and their customer service got progressively worse. Both their customer service problems and their subprime exposure were related to the same core problem - poor leadership. I have always stated that my desire was for Washinton Mutual to take the information I publish on this site and use it to improve their customer service; it appears that this is up to JP Morgan Chase now, which I hope is a much better bank.

To continue to provide a place where people can share their experiences, I have added jpmorganchasesucks.org as an address for this site. Because I don't have any experience with JP Morgan Chase, and to be fair, I have also added the jpmorganchasedoesntsuck.org adress. If people are happy with them, I'll retire the sucks address.

The next few months will be a critical time for all (former) WaMu customers. Please continue to send me your stories so everyone can see how the transition is going. If things get better or worse, people need to know about it.

If you are a JP Morgan Chase customer, all of your WaMu bretheren want to know what kind of a bank they are getting; please send me your stories, both good and bad.

Peter

My Story (First written in 2005)

Hello and welcome to the expressions of my frustration with Washington Mutual Bank. I hope this information helps to direct you away from doing business with them until they improve their operations, policies, and customer service.

The behavior of a business usually reflects the guidance and thinking of the people at the top. Because of this

I fully expect that problems and dissatisfaction in one area is typically reflective of what you will experience in other areas of the business. Because so many people have had problems with Washington Mutual, it is clearly in their corporate culture.

In 2002, I decided to reduce the amount of direct mail I was getting by calling all the companies that were sending the stuff to me and asking them to stop sending it. Simple, right? For those of you that don't know, it is your full and legal right by Federal law to ask someone to stop sending you direct mail, and they must stop! Most of the organizations I contacted were more than happy to take me off of their mailing list. Now, being a homeowner, mortgage refinance solicitations make up about 30% of all junk mail I get. Thirty percent! That is HUGE! Washington Mutual is by far the largest abuser of this form of direct mail!

When I first started contacting WaMu to stop sending me the mortgage refinance junk mail, I actually already had a home loan with WaMu. That I already had a mortgage with WaMu and yet brokers from all over California were sending me refinance offers just baffles me. At that time I was also registered with their privacy department to not receive any offers from them. For those of you that don't remember, earlier this decade, financial institutions lobbied for and got the ability to share your sensitive financial information with outside entities for marketing and promotional purposes. What they had to do to get this was to agree to send opt-out notices to you where you could opt out of all information sharing as well as whether you wanted to receive any solicitations from them.

In the last several years, I have contacted WaMu over 20 times trying to get them to stop sending me refinance offers. At first they seemed helpful. I contacted each broker as I received a flyer and they said the would take me off of their list. But the mail kept coming. So I contacted the corporate offices and after being bumped around a bit I was put in touch with one of thier corporate customer satisfaction officers. She appologized for the inconvenience, told me that in fact brokers should be using the corporate do-not-mail list (which I was on) before sending out direct mail, and that she would take care of the problem.

I received another mortgage refinance offer from them. I contacted the corporate customer satisfaction officer and she again appologized and said she would take care of it. I received a confirmation that I wouldn't be receiving any more mail. But I received several more. This time, the WaMu officer changed her tune and told me that they had every legal right to send me whatever direct mail they wanted. How arrogant is that! I informed her that she was in fact incorrect and sent her all the information on the applicable Federal laws. She responded that their legal department reviewed the information and determined that they still had the right to send me whatever they wanted. Hmm. I guess a Supreme Court ruling wasn't enough to convince them.

I have spent a lot of time filing Better Business Bureau complaints against them, sending more letters to their corporate offices and individual brokers and regional offices, but they just won't stop. Which is why I created this website ... to share my experience with you. Do you want to do business with a company that is so disorganized that it can't get its brokers to use its internal do-not-mail list which is their corporate policy? Do you want to do business with a home lender that is by far the worst offender in the obviously misleading 3% mortgage refinance offer schemes and doesn't care how it treats its current and former customers? (Update 9/8/08: When I wrote this in 2005, the subprime meltdown had not yet happened. We all know the results of those 3% mortgage rates now.)

I don't. And after hearing about Scott Donnelly's experience, I definitely won't be doing business with WaMu again. But, sticking it to WaMu isn't really what I am after. My real desire is to pressure them to be a more responsible organization. If you care about things like this, please email their customer satisfaction department and let them know that you saw this site and are disappointed that they don't handle customer issues better. Your help will be apprecaited.

Update: Reader Kevin V suggests this for getting hold of a live person to complain to: Dial 1-800-788-7000 and then dial 162 when you get connected.

Update: Reader Henry suggests the following:

"If you have a problem with WaMu, don't spend too much time on the phone with them. Instead, file a formal complaint with the Office of the Comptroller of the Currency; part of the Treasury Dept. that regulates banks:

State the facts clearly and be certain to state that you are a victim of WaMu's deceptive business practices and lack of adherence to federal banking laws. Send a copy to both of your Senators and your US Representative."

If you have your own WaMu story, please send it to me at ![]() so I can add it to this site.

so I can add it to this site.

As alternatives to Washington Mutual, I suggest First Republic Bank for personal and business banking. They are a truly exceptional bank that really seems to get the essense of customer service. As for an alternative for home loans, I used to recommend Countrywide, but I recently had a nightmare problem with their screwy online statements and got very little satisfaction trying to iron out the problem with their customer service, so I can no longer recommend them.

Sincerely

Peter