Yup, another article in a major metropolitan newspaper (the Los Angeles Times and reprinted in the Columbia Daily Tribune) about people getting fed up with their bank and leaving it. As often seems the case, the bank in this example is Washington Mutual Chase. Seems they were very happy with Washington Mutual and feel that customer service has gone downhill and the ridiculous fees have gone up since Chase took over.

Yup, you guessed it, they moved to a credit union.

BY E. SCOTT RECKARD Los Angeles Times

Adding insult to injury, Roberta said, they had to pay a fee for depositing more than $5,000 in cash to their small-business account in a month — something they might do again because Mark, a saxophone player, earns much of his living selling his CDs at street fairs. “I thought banks were supposed to want you to put more money in,” Roberta said.

Mark and Roberta Maxwell had been zapped by fees for overdrawing funds and using the wrong ATM, and they felt their bank, once Washington Mutual, had lost its personal touch since a takeover by Chase.

Read more …

The part that kills me is that Chase is actually charging someone for depositing TOO MUCH money in their account in one month. Are you kidding? Aren’t banks supposed to want more deposits? Especially Chase, who it seems has been drastically losing deposits and customers for a year or more, as far as we can tell.

Hoping to succeed where Washington has largely failed, New York City’s comptroller, John C. Liu, and six large unions plan to begin a campaign on Wednesday to press the biggest banks to do more to prevent foreclosures in the New York area.

Mr. Liu said the group would send Citigroup, JPMorgan Chase, Bank of America and Wells Fargo, among others, a letter that criticizes them for dragging their feet on modifying mortgages that are underwater or delinquent, and that urges them to do “everything possible” to avert foreclosures.

Depending on the response the coalition members get, they might move pension funds and bank deposits to other institutions, according to union officials.

Read more …

NEW YORK (Dow Jones)–Charles Schwab Corp. (SCHW) is suing units of three banks over the sale of mortgage-backed securities to the company’s bank, alleging the firms made false statements or omitted facts about the credit quality of loans that backed the investments.

The banks named in the complaint filed on June 29 include units of Bank of America Corp. (BAC), UBS AG (UBS), and J.P. Morgan Chase & Co. (JPM). Two units of Wells Fargo & Co. (WFC) are also named in documents, though the bank wasn’t one of the securities dealers that sold certificates to Schwab. Rather, Wells Fargo is considered an issuer of the certificate that UBS sold to Schwab.

In a filing with Superior Court of California, County of San Francisco, Schwab said it purchased three certificates in three securitization trusts backed by residential mortgage loans for $130 million.

Schwab alleges that defendants in the suit “made untrue statements, or omitted important information, about such material facts as the loan-to-value ratios of the mortgage loans, the number of borrowers who did not live in the houses that secured the loans and the extent to which the entities that made the loans departed from their standards in doing so.”

The complaint alleges that more mortgage loans other than those listed in the document “were the subject of untrue or misleading statements.”

The complaint says that because the certificates are securities, under two California securities acts, Schwab believes it is entitled to rescind the purchase of the certificates or be paid damages for losses on the certificates.

Read more …

This story makes sense; Chase forecloses on a multi-tenant building and then owns it, or is responsible for managing it if the mortgage had been sold as a CDO. For two years Chase does absolutely nothing to keep the property up and it ends up in such poor shape that the city condemns it and kicks all the tenants out.

The story began over 2 years ago when foreclosure proceedings began. This Saturday, July 17th 2010, the residents of 7263 S. Coles will be homeless. JP Morgan Chase has been responsible for maintaining this property since 2008. For two years Chase hasn’t honored its responsibility, and the building deteriorated to such a degree that the City stepped in and ordered residents to vacate the property this coming Saturday (July 17th). The tenants will be put out on the street.

Update: Here is some video of the tenants protesting their eviction.

Let’s say you are a big thoughtless bank and you some customers you inherited from other banks you stole bought, but those customers have a great deal in a low-interest-for-life loan that other banks offered as a promotion, either for a big purchase, or a balance transfer from another credit card. Your problem is you want them to be paying a higher interest rate, but these are good customers with good credit scores who are paying on time. Hmm, what to do.

Wait, I’ve got it! Let’s increase their minimum payment, either forcing them to default on their loan, which allows us to increase their interest rate to something nearly illegal, or force them to agree to a higher rate in exchange for lower payments.

If you think this way, that might make you Chase bank. Full story below.

My credit has always been quite excellent, I have never defaulted on any credit or loan. My score is well into the upper 700 range. Chase has tried to screw me several times in the pass by jacking up my interest rate within just one statement period. Worse case. From 8.98% to 29.99% in just one month. I should have learned my lesson back then. But my personal checking was with BANK ONE(now CHASE) just down the street and I know the tellers and branch manger on a personal level.

HOWEVER! The final straw!

My story: Last February or so, I took one of their “Offers” 3.99% for the life of the balance. I needed a new furnace and windows so I used just over $20,000.00. My Credit limit was also raised to around $26,000.00 during this “special offer”. I paid the 3% upfront fee and continued to make not only the min due, but pay as much extra as my monthly budget would allow. Min payment due was around $400.00

NOW HERE is the reason CHASE_SUCKS. I get my September statement. My min payment due went up to almost $1,100.00! I checked my previous statements for any warning or info about this. NONE! I called and was told that I was sent a letter about 45 days ago outlining the reason for this. After explaining to them that I am not able to shit or grow an extra $700.00 every month. I am a single parent trying to raise my daughter with no help from her mother or anyone else for that matter and the two jobs I currently have just doesn’t leave room for much else. I ask what would happen if I cant make the min. due. You guessed it. “Default account! All kinds of Fees and charges. Current rate will rise to the now default rate on 27.9%”. When I asked about our agreement and the 3.99% offer. The manager stated. “it was a business decision on our part to HELP you pay off you account sooner, as well, we are allowed by law to make changes to our offers and account terms by sending you a 45 day notice”. So in other words, Because greedy chase is not making enough money off of me, they use some loop hole to increase my min due to an impossible amount so my perfect credit history gets trashed, so CHASE can rack up my interest rate and RENEGE on THEIR own offer.

I believe CHASE wants us to default and fail, so they cant continue to receive more government money, blame their problems and their own miss management on us the consumers, so as to keep their multi million dollar paychecks and mansions. All I can figure out in this whole mess; Is that the “powers to be” must really want Anarchy.

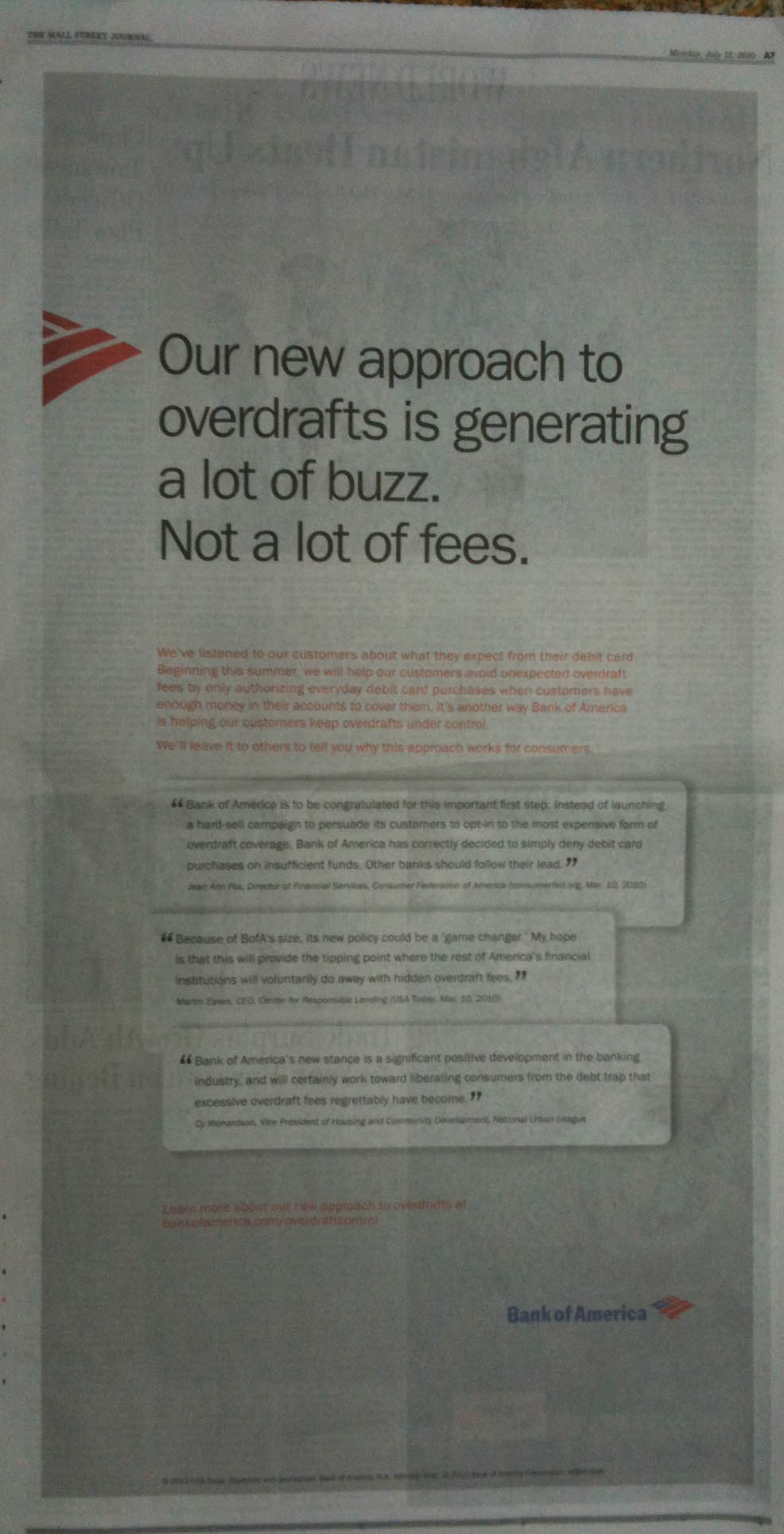

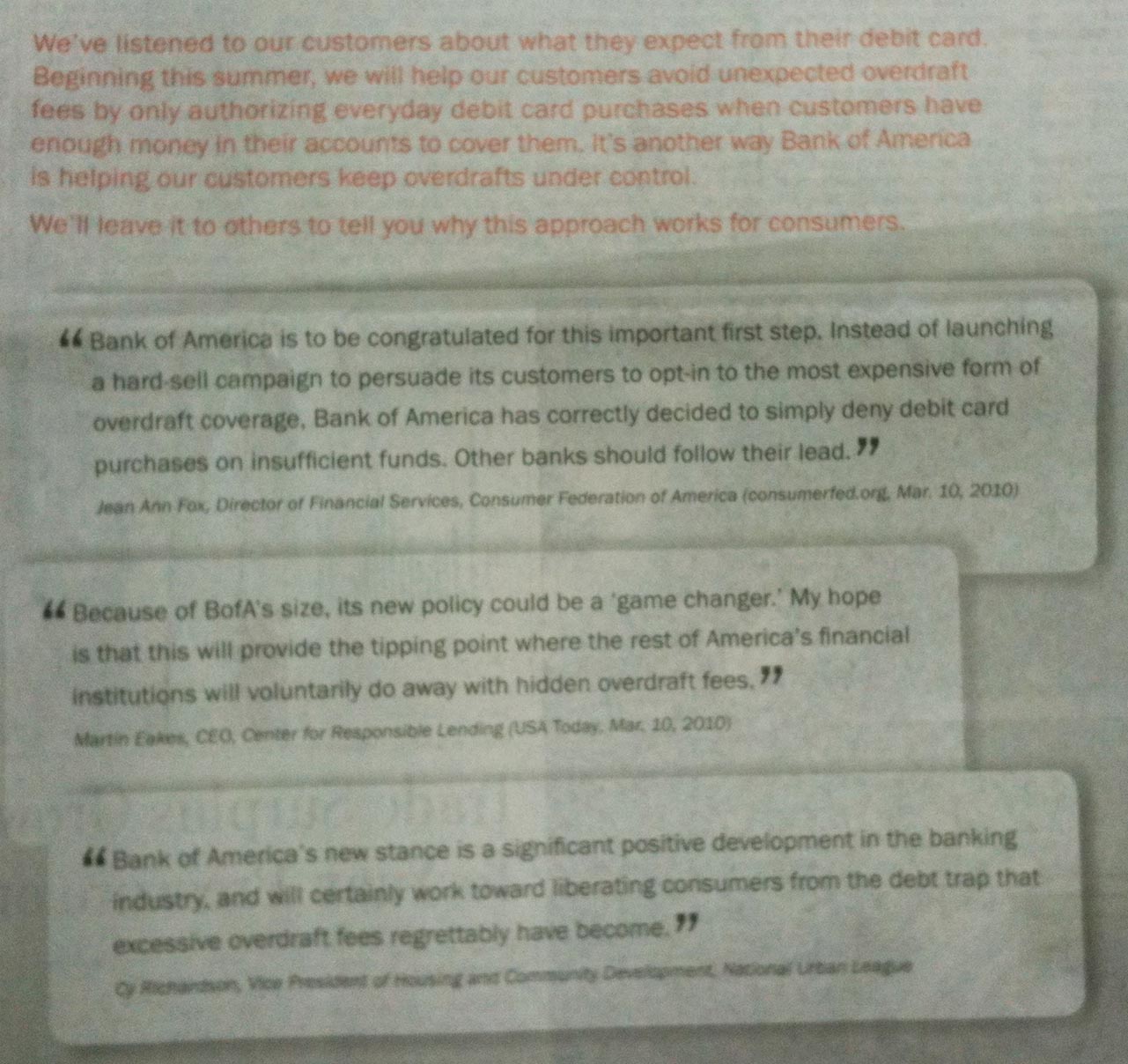

Bank of America is touting its new consumer friendly debit card overdraft policy in a full page Wall Street Journal ad in this mornings paper.

Bank of America decided that doing away with debit card overdraft “protection” was in the best interest of its customers, as most people expect debit cards to stop working once an account is out of money. One danger with debit cards that work as credit cards is that you grab the wrong card to make a big purchase. This wouldn’t make you inept at managing your account, just human. A mistake like that is likely to happen to everyone at least once in their lifetime.

Our new approach to overdrafts is getting a lot of buzz. Not a lot of fees.

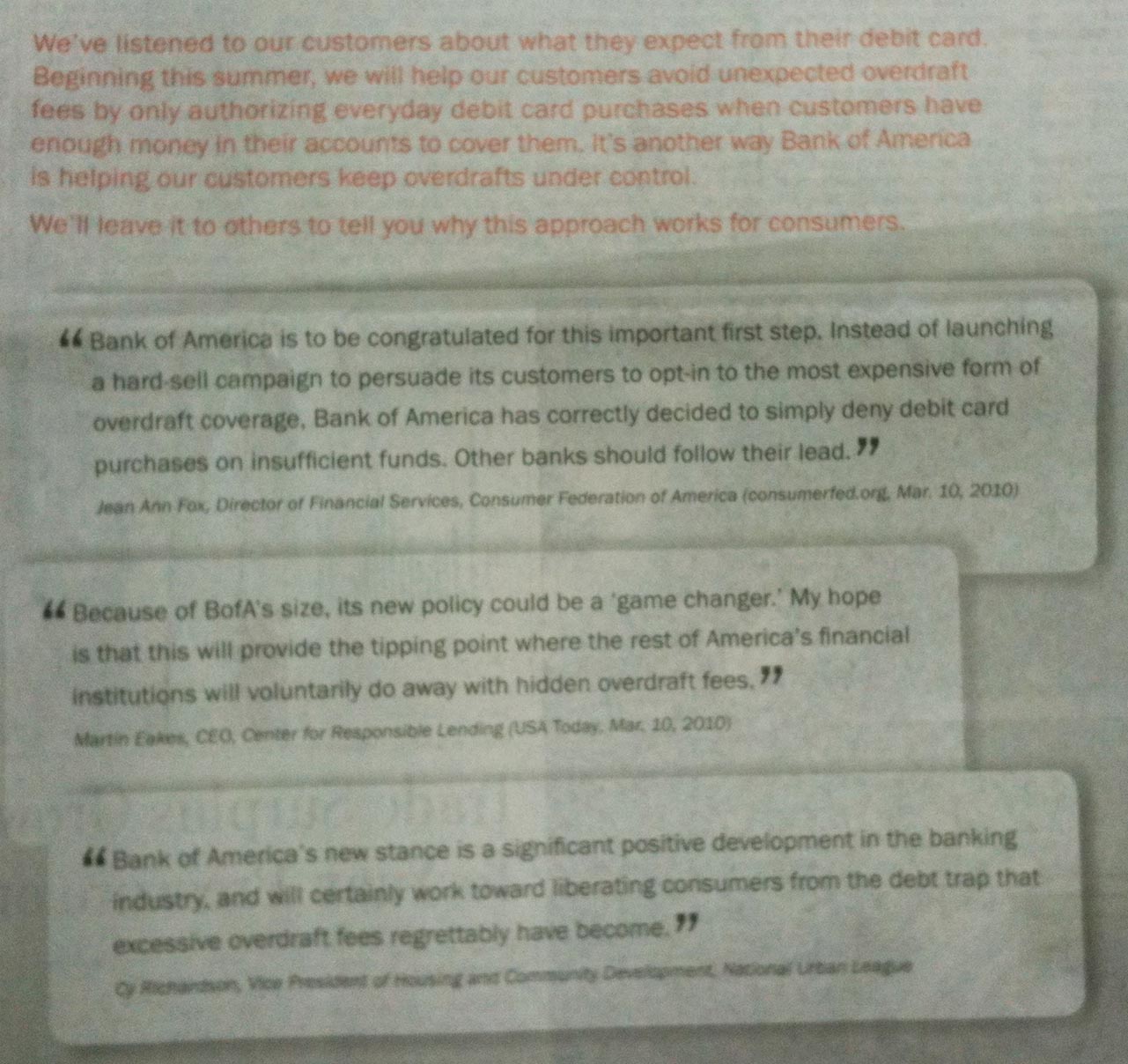

We’ve listened to our customers about what they expect from their debit card. Beginning this Summer, we will help our customers avoid unexpected overdraft fees by only authorizing everyday debit card purchases when customers have enough money in their accounts to cover them. It’s another way Bank of America is helping customers keep overdrafts under control.

“Bank of America is to be congratulated for this important first step. Instead of launching a hard-sell campaign to persuade customers to opt-in to the most expensive form of overdraft coverage, Bank of America has correctly decided to simply deny debit card purchases on insufficient funds. Other banks should follow their lead.” – Jean Ann Fox, Director of Financial Services, Consumer Federation of America

There are a couple more quotes in the ad which I have left out as the first quote correctly captures the spirit of the ad; they are calling out other banks, especially Chase, which has been accused of fear-mongering tactics to get people to sign up for overdraft protection once they can’t offer it by default.

This story is so incredible it is just believable.

A customer, who got into a argument with a Chase branch manager went over her head and apparently pissed her off, because a couple of days later he found a $10 million debit on his account. It seems the branch manager was determined to make sure he wouldn’t have the benefit of his own money over the 4th of July weekend.

American’s credit scores have sunk to a new low.

NEW YORK – The credit scores of millions more Americans are sinking to new lows.

Figures provided by FICO show that 25.5% of consumers – nearly 43.4 million people – now have a credit score of 599 or below, marking them as poor risks for lenders. It’s unlikely they will be able to get credit cards, auto loans or mortgages under the tighter lending standards banks now use.

Because consumers relied so heavily on debt to fuel their spending in recent years, their restricted access to credit is one reason for the slow economic recovery.

Read more …

Perhaps lost in this article is the fact that many people’s credit scores are in fact lower because banks like Chase have gone and significantly reduced credit lines, with no reasoning, explanation, or notification. A reduction in a credit line to the outstanding balance creates a high credit limit to loan balance ratio which is bad for credit scores.

The fact that Chase doesn’t notify customers when it does this also makes it very likely that someone will use their credit card and go over their newly lower limit, thus incurring an over-limit fee. Thanks Chase.