Seems simple enough, you get a fixed rate auto loan from Chase and expect that over the life of the loan, the amount paid in interest will go down over time until the loan is paid off. Why then is this Chase customer seeing repeated increases in the amount of interest he is paying, even when he is increasing his principal payment?

Perhaps Chase snuck something sneaky into the fine print.

I couldn’t pass up this nasty rumor:

Is Chase Bank funding terrorism?

I know chase bank funded the cold war and Vietnam against the US but recently I read a report that they are now funding freedom fighters Alqeda and other military factions in Iraq and Afghanistan.

I don’t like the military in any way and Chase keeps inviting me to apply for a credit card but I am not sure what they are involved in.Are they funding terrorism and wars?

Additional Details

The bank also funded the contra rebels in South America during the 1980’s.

They basically fund the enemy nations.

Check many International Almanacs dictionaries and government sources.

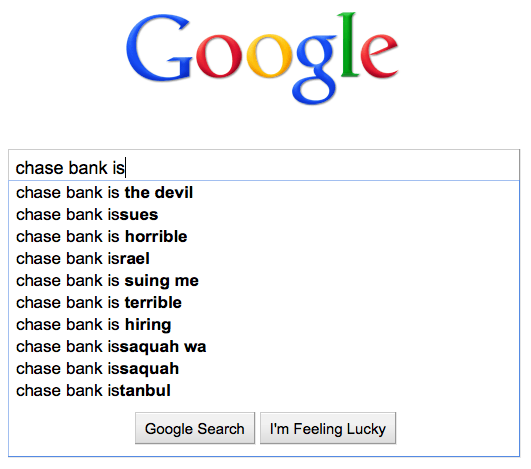

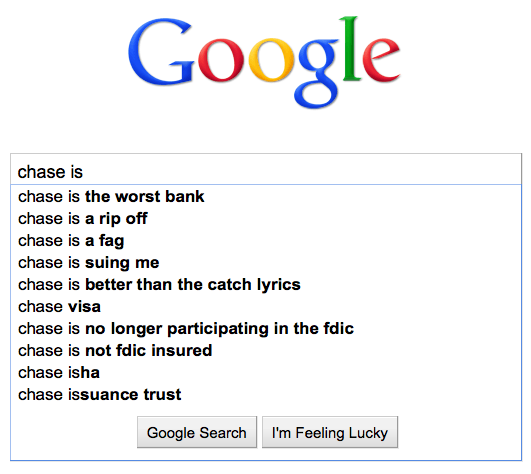

Google search offers suggestions when you start entering search terms that are based on the most popular terms others have searched on that match what you are typing. Clearly, from what Google suggests, people are not happy with Chase.

Chase is nothing if not creative. Their latest bit of creativity that is aimed at increasing fees is to say that a payment is due at the end of business hours on the due date rather than the actual end of the day. Furthermore the end of the business day is in their time zone (EST) not the one that you are in. With electronic payments these days, the end of business hours is not the end of the ability to make a payment, so business hours shouldn’t be important.

I suspect that some bean counter at Chase figured out that quite a few payments were technically on time according to their old rules but could be considered late if they just changed their rules a little bit.

Ok, it is now May of 2010, nearing on two years since Chase took over WaMu and its crappy credit card portfolio. In response to the crappyness of WaMu’s credit card portfolio, they began to slash credit limits. One would think they would have limited this to the customers that were actually credit risks, but from reports we received, they seemed to slash credit limits arbitrarily without regard for whether people were risky or not. And they did so without informing people in any way, either before or after they made the changes to peoples accounts. The only indication could be found on customer’s monthly statements, where the credit limit itself was indicated.

So now, 20 months after they began this slash and burn campaign, why are the still doing this?

Is this a new way for Chase to get people to default on their loans?

Bobby changed his password for his Chase account for an auto loan and was subsequently unable to log in. Each time he try’s to log in it asks him for his credit card number. The problem is, he doesn’t have a credit card with Chase so is unable to provide a number. He has been trying to solve the problem for two months. He finally was able to make a payment:

I was able to call them and make a payment over the phone. The special fee charged to me associated with this highly unorthodox method of payment was only $14.00(US)

Yea, they charged him to make a payment by phone when he was unable to log into his account and they couldn’t solve the problem.

There was apparently some unhappy shareholders at a record turnout for JP Morgan Chase’s annual meeting where CEO Jamie Dimon was scolded for, among other things, a low dividend, foreclosures, sleazy business tactics, and support of mountaintop removal coal mining.

Another lawsuit calling out Chase for bad behavior. This time related to the practice of telling homeowners to stop making mortgage payments so they will quality for a loan modification:

JPMorgan Chase instructed homeowners to stop making mortgage payments, as that was the only way to be considered for a loan modification, then repossessed their house when they followed the bank’s advice, a couple claims in Federal Court.

The process seems to go like this:

1. Chase recommends stopping payments to qualify for a loan modification

2. Chase approves a trial modification.

3. Chase works in parallel on foreclosure actions

4. Chase denies permanent modification after an extended trial modification and then demands all missed payments in a lump sum or they will foreclose, or Chase skips this step and just forecloses.