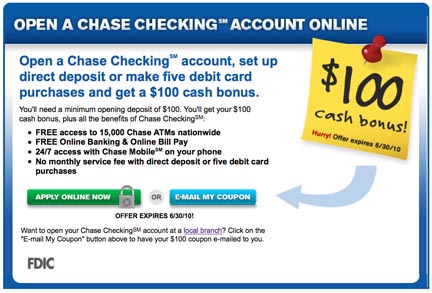

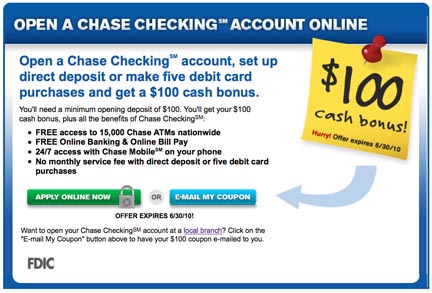

Like a rug store perpetually going out of business, Chase keeps running these “Hurry and sign up for a new checking account because the offer expires soon” promotions. The last one expired on June 30th, and surprise surprise, they now have another one that expires August 14th.

News flash: Washington Mutual ran a constant $100 for a new checking account promotion and Chase has pretty much run the same promotion for years now. Chase, we’ll get excited when you are actually doing something interesting.

Like Washington Mutual before it, Chase has been offering a $100 bonus for signing up for a new checking account (with minimum deposit of $100, recurring electronic deposit, account must remain open for six months minimum) pretty much forever. So why does their latest campaign say hurry, offer expires 6/30/10? This sounds suspiciously like the rug store down the street with a perpetual going out of business sale.

In a recent interview with a German newspaper, Chase CEO Jamie Dimon gave us a glimpse of exactly what is wrong with the banking industry, and Chase in particular. For instance he said that “when profits fall too sharply then capital will move somewhere else, where there is more money to be earned, for example non-regulated markets,” and “the banking industry could do with more influence on politicians.”

Does anyone really believe that the banking industry has been underrepresented in Washington influence in the past?

The problem here is that the ability of banks to take out-sized risks that throw the whole financial system into harms way, to abuse their customers with unreasonable fees and abusive behavior, and to make out-sized profits from all of this, is at risk with recent reform efforts.

Banks have often complained recently that limiting their ability to throw huge bonuses at their staff (and especially their leadership) curtails their ability to retain talent, that people will leave for other companies. But if the entire industry is held to the same standards, where exactly are these financial “geniuses” going to go to earn the same kind of money? There simply aren’t other industries where people can siphon money out of the economy in this way.

This makes perfect sense: Chase is giving away $20 for people that sign up for automatic payments with their debit card. According to the Center for Responsible Lending’s Debit Card Danger document, banks steer customers to use debit cards because all new accounts are signed up for automatic overdraft protection, which leads to huge amounts of overdraft fees, primarily from debit card use. Using debit cards for automatic payments will just create more overdrafts and thus more fees.

“R” writes:

“Hello,

I am actually writing because I don’t entirely agree that washington mutual’s customer service sucks. I am only saying this because I worked there for a long time and also had an account there. However, the same can not be said for Washington Mutual CEO Kerry Killinger. Kerry Killinger’s ridiculous antics and total greed have completely degraded the moral of employees. Washington Mutual in Seattle pays their tellers 11.00 dollars an hour to be berated, belittled, and generally used as a doormat while Kerry Killinger collects 300 times his salary as a nice little bonus (highest paid CEO on the west coast anybody?). The company also expected female tellers to wear shirts stating “WOOHOO” right across their chest region, often resulting in female employees being called woohooters girls. Try dealing with every scum bag in Seattle humilating you by make obscene comments and you may have an idea as to why our tolerance may be lower than it should… I don’t agree with the companies policies and selling information to other companies, nor do I agree with the system they use to “sell sell sell”… and I most definitely think the telephone banking system is completely flawed and horrible… but I am beseeching on behalf of the littler people of the company, be nice to the tellers… they don’t get paid nearly enough to be harrassed or screamed at. If you want to scream at someone, Go ahead… just ask for the district manager. Please note that I do understand your frustrations and I am only writing this because I have lived through the horrors of being a teller at a company that doesn’t do anything for the little people… who ironically do EVERYTHING for the company.

Thank you…

Former WaMu teller

p.s. I have had bad experiences with branches other than mine as well, but there are a lot of nice people that work for this questionable company.”

(Peter’s note: Thanks for your email. Thanks for reminding me that in the whole debacle there are innocents caught in the middle. I could not agree with you more about the poor management that WaMu has had; I experienced this myself dealing with the corporate office. I also think the poor leadership has put incapable people in the wrong positions, which is why so many people are writing me about dealing with incompetents at WaMu. But surely there are a lot of competent people that just want to do their jobs. My heart is out to them, as I have worked in dysfunctional companies before, and it is no fun.)