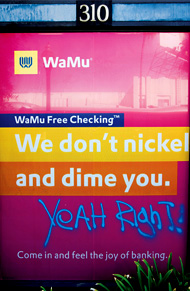

Hello and welcome to the expressions of my frustration with Washington Mutual Bank. I hope this information helps to direct you away from doing business with them until they improve their operations, policies, and customer service.

The behavior of a business usually reflects the guidance and thinking of the people at the top. Because of this

I fully expect that problems and dissatisfaction in one area is typically reflective of what you will experience in other areas of the business. Because so many people have had problems with Washington Mutual, it is clearly in their corporate culture.

In 2002, I decided to reduce the amount of direct mail I was getting by calling all the companies that were sending the stuff to me and asking them to stop sending it. Simple, right? For those of you that don’t know, it is your full and legal right by Federal law to ask someone to stop sending you direct mail, and they must stop! Most of the organizations I contacted were more than happy to take me off of their mailing list. Now, being a homeowner, mortgage refinance solicitations make up about 30% of all junk mail I get. Thirty percent! That is HUGE! Washington Mutual is by far the largest abuser of this form of direct mail!

When I first started contacting WaMu to stop sending me the mortgage refinance junk mail, I actually already had a home loan with WaMu. That I already had a mortgage with WaMu and yet brokers from all over California were sending me refinance offers just baffles me. At that time I was also registered with their privacy department to not receive any offers from them. For those of you that don’t remember, earlier this decade, financial institutions lobbied for and got the ability to share your sensitive financial information with outside entities for marketing and promotional purposes. What they had to do to get this was to agree to send opt-out notices to you where you could opt out of all information sharing as well as whether you wanted to receive any solicitations from them.

In the last several years, I have contacted WaMu over 20 times trying to get them to stop sending me refinance offers. At first they seemed helpful. I contacted each broker as I received a flyer and they said the would take me off of their list. But the mail kept coming. So I contacted the corporate offices and after being bumped around a bit I was put in touch with one of thier corporate customer satisfaction officers. She appologized for the inconvenience, told me that in fact brokers should be using the corporate do-not-mail list (which I was on) before sending out direct mail, and that she would take care of the problem.

I received another mortgage refinance offer from them. I contacted the corporate customer satisfaction officer and she again appologized and said she would take care of it. I received a confirmation that I wouldn’t be receiving any more mail. But I received several more. This time, the WaMu officer changed her tune and told me that they had every legal right to send me whatever direct mail they wanted. How arrogant is that! I informed her that she was in fact incorrect and sent her all the information on the applicable Federal laws. She responded that their legal department reviewed the information and determined that they still had the right to send me whatever they wanted. Hmm. I guess a Supreme Court ruling wasn’t enough to convince them.

I have spent a lot of time filing Better Business Bureau complaints against them, sending more letters to their corporate offices and individual brokers and regional offices, but they just won’t stop. Which is why I created this website … to share my experience with you. Do you want to do business with a company that is so disorganized that it can’t get its brokers to use its internal do-not-mail list which is their corporate policy? Do you want to do business with a home lender that is by far the worst offender in the obviously misleading 3% mortgage refinance offer schemes and doesn’t care how it treats its current and former customers? (Update 9/8/08: When I wrote this in 2005, the subprime meltdown had not yet happened. We all know the results of those 3% mortgage rates now.)

I don’t. And after hearing about Scott Donnelly’s experience, I definitely won’t be doing business with WaMu again. But, sticking it to WaMu isn’t really what I am after. My real desire is to pressure them to be a more responsible organization. If you care about things like this, please email their customer satisfaction department and let them know that you saw this site and are disappointed that they don’t handle customer issues better. Your help will be apprecaited.

Update: Reader Kevin V suggests this for getting hold of a live person to complain to: Dial 1-800-788-7000 and then dial 162 when you get connected.

Update: Reader Henry suggests the following:

“If you have a problem with WaMu, don’t spend too much time on the phone with them. Instead, file a formal complaint with the Office of the Comptroller of the Currency; part of the Treasury Dept. that regulates banks:

State the facts clearly and be certain to state that you are a victim of WaMu’s deceptive business practices and lack of adherence to federal banking laws. Send a copy to both of your Senators and your US Representative.”

If you have your own WaMu story, please send it to me at  so I can add it to this site.

so I can add it to this site.

As alternatives to Washington Mutual, I suggest First Republic Bank for personal and business banking. They are a truly exceptional bank that really seems to get the essense of customer service. As for an alternative for home loans, I used to recommend Countrywide, but I recently had a nightmare problem with their screwy online statements and got very little satisfaction trying to iron out the problem with their customer service, so I can no longer recommend them.