Thanks to this article about Chase adding texting features to their account balance alert service, I now understand why their balance alerts are useless; they aren’t sent out until the end of the day.

Think about this for a second. Something happens during the day, presumably unexpected, which pulls your account balance below and amount that you want to know about. If this happens early in the day, lots of other things can happen before you find out about it. By the time you get the alert, it may very well be too late.

Kinda worthless. But I think Chase knows this. If they told you in a timely fashion that a problem might occur, they might not make as much in fees.

Seems simple enough, you get a fixed rate auto loan from Chase and expect that over the life of the loan, the amount paid in interest will go down over time until the loan is paid off. Why then is this Chase customer seeing repeated increases in the amount of interest he is paying, even when he is increasing his principal payment?

Perhaps Chase snuck something sneaky into the fine print.

I couldn’t pass up this nasty rumor:

Is Chase Bank funding terrorism?

I know chase bank funded the cold war and Vietnam against the US but recently I read a report that they are now funding freedom fighters Alqeda and other military factions in Iraq and Afghanistan.

I don’t like the military in any way and Chase keeps inviting me to apply for a credit card but I am not sure what they are involved in.Are they funding terrorism and wars?

Additional Details

The bank also funded the contra rebels in South America during the 1980’s.

They basically fund the enemy nations.

Check many International Almanacs dictionaries and government sources.

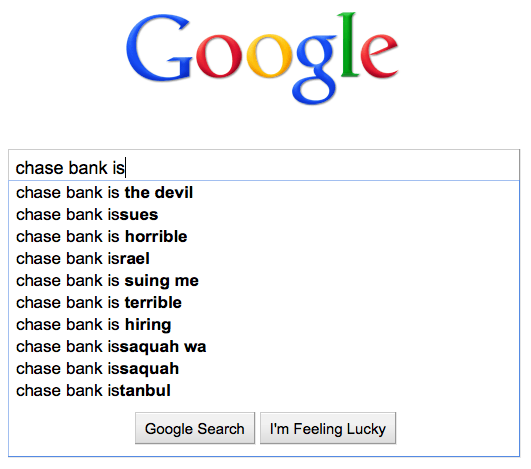

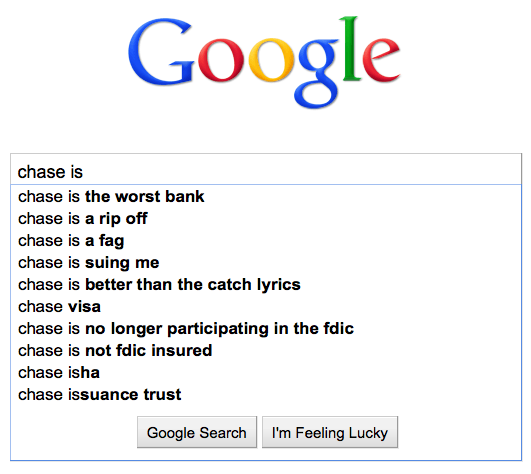

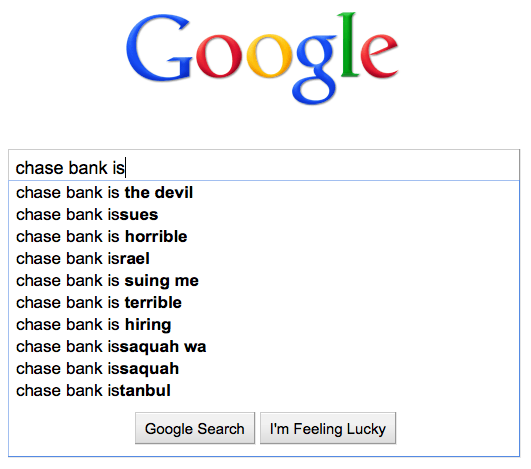

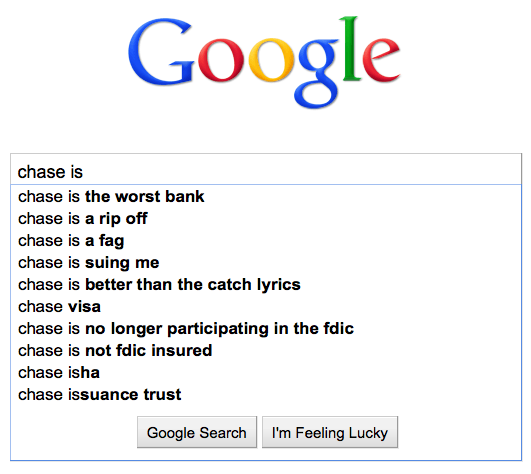

Google search offers suggestions when you start entering search terms that are based on the most popular terms others have searched on that match what you are typing. Clearly, from what Google suggests, people are not happy with Chase.

Chase is nothing if not creative. Their latest bit of creativity that is aimed at increasing fees is to say that a payment is due at the end of business hours on the due date rather than the actual end of the day. Furthermore the end of the business day is in their time zone (EST) not the one that you are in. With electronic payments these days, the end of business hours is not the end of the ability to make a payment, so business hours shouldn’t be important.

I suspect that some bean counter at Chase figured out that quite a few payments were technically on time according to their old rules but could be considered late if they just changed their rules a little bit.

Ok, it is now May of 2010, nearing on two years since Chase took over WaMu and its crappy credit card portfolio. In response to the crappyness of WaMu’s credit card portfolio, they began to slash credit limits. One would think they would have limited this to the customers that were actually credit risks, but from reports we received, they seemed to slash credit limits arbitrarily without regard for whether people were risky or not. And they did so without informing people in any way, either before or after they made the changes to peoples accounts. The only indication could be found on customer’s monthly statements, where the credit limit itself was indicated.

So now, 20 months after they began this slash and burn campaign, why are the still doing this?

I can’t get the whole story because it is behind a paywall, but according to this headline, Washington Mutual shareholders are appealing the judges decision against appointing an independent examiner to investigate WaMu’s seizure and sale by the FDIC.

In the latest settlement agreement between JP Morgan Chase and WaMu’s former holding company (and the FDIC), Chase is backing away from its claim to tax refunds in exchange for a larger share of the WaMu assets.

Does anyone else think it is strange that Chase is laying claim to $6.4 billion in assets when they paid only $1.9 billion for all the banks assets in 2008? Someone is getting screwed here and I think it is the WaMu shareholders and bondholders.