Chase Bank’s decision to remove a donated Christmas tree from its Southlake branch has generated widespread national attention and threats from customers to pull their accounts from the bank.

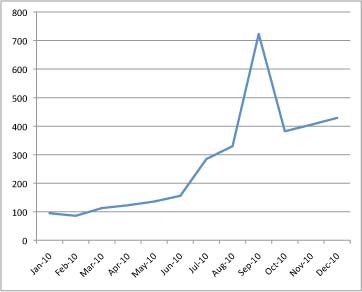

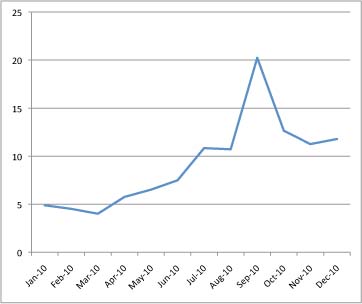

More than 2,000 online comments have been posted on the Star-Telegram’s website, an unusually high number for any article, since the newspaper broke the story Dec. 2. Many were angry over what they saw as a war on Christmas.

Chase defended itself, saying only company-issued decorations, including Christmas trees, are allowed in the banks.

After the initial backlash, Chase decided to “apply common sense” and allow the tree’s owner to put the Southlake tree back up at the bank’s expense, said Greg Hassell, a JPMorgan Chase spokesman.

Antonio Morales, the tree’s owner, said he’s not interested and that he would put the tree up at his home or in another bank. He also will bank elsewhere.

Hassell declined to comment on whether customers were leaving the bank.

The donated tree was simply a gift. Morales, owner of Bellagio Day Spa in Southlake, assembled and decorated the 9-foot-tall tree in the lobby of the Chase Bank branch at 1700 E. Southlake Boulevard as a favor to the branch manager, who is one of his clients.

“Southlake is known for its beauty,” Morales said. “I wanted that bank to have a good-looking tree because they didn’t have anything.”

The white tree–covered with LED lights and white and silver ornaments and bows–remained in the lobby from the Monday before Thanksgiving until Nov. 30. Morales said his friend called him the next day telling him to pick up the decorations.

She later showed him an e-mail from JPMorgan Chase saying that the tree had to be removed because it violated company policy.

That policy prohibits customers from making gifts to the bank of any kind, Greg Hassell, a JPMorgan Chase spokesman.

“We appreciate the thoughtful gesture from Mr. Morales,” Hassell said.

Since the story first broke, it has remained the most-read story on the newspaper’s website even days later.

It’s also been picked up by area television stations and major news sites nationwide.

Other Chase banks have Christmas trees in their lobbies, including the location in south Fort Worth on Everman Road, but they are company-issued decorations.

JPMorgan Chase ensures that decorations are “something everyone is comfortable with, regardless of how they celebrate the season,” Hassell said.

“People wish their customers Merry Christmas when it’s appropriate,” he said.

Hassell said that the Southlake branch was supplied with stickers that resemble Christmas lights. Company-supplied decorations vary at other branches, he said.

“Normally they’re small, not intrusive. I’m not sure this [Morales’] Christmas tree was intrusive. That’s not really the issue here. It isn’t a company-supplied decoration.”

Hassell said the policy has been around for a few years, and that decorations change every year.

Morales said he believes Chase removed the tree because it offended customers who don’t celebrate Christmas.

“It wasn’t because it was a gift,” he said.

Other banks are taking advantage of Chase’s bad press.

The Providence Bank of Texas in Southlake, which displays Christmas trees and a nativity scene, has had an influx of new customers who are bailing from Chase, said Randy McCauley, president and chief executive officer.

Providence makes its decisions locally and the directors are Christians who embrace the positive message of the holiday season, McCauley said.

“We unapologetically put Christmas trees and Christmas decorations around our bank,” said Mark Lovvorn, the bank’s chairman.

Bryan Fischer, director of issue analysis for the American Family Association, called Chase’s decision absurd.

The non-profit, conservative Christian group is based in Mississippi. Allen Praytor, a Southlake Chase customer, said he will remain a customer but believes the bank waffled too much whether to leave the tree up or down.

“It’s too inconsistent and it’s emotionally driven,” Praytor said. “I don’t like emotionally based decisions. Are they going to make a decision on a whim?”