We’ve documented lots of examples where Chase doesn’t bother informing customers of important things happening with their accounts, but this story has to be the worst. After reading this entire story, I am struck how the root of the problem was that Chase didn’t adequately inform a customer who was doing their best to stay current on their loan, despite some hardships, of their true obligations. It’s almost as if the people at Chase simply didn’t care what hassle and inconvenience their lackadaisical approach to banking causes people.

Financed a brand new Subaru Outback from Chase Auto Finance in September, 2005. Had to file Chapter 7 bankruptcy in May, 2009, due to infant son’s medical and hospital bills. Payments were current at time of bankruptcy discharge. Did not reaffirm the loan, as we had equity in the car at that point. Continued to make monthly payments on the car to Chase via Moneygram. Paid almost $8,000 in the almost two years since the bankruptcy. Had calculated that I owed about $1,400 in March. On March 25, a tow truck showed up to repossess the car. I couldn’t believe that Chase would repossess the car for such a small amount owed and the fact that we had so much equity in it. I called the Chase bankruptcy department while the tow truck driver waited. I was told that the $1,400 was a balloon payment from when I had deferred a couple payments years earlier when my son was hospitalized. With everything that has happened since then, I had completely forgotten that the last payment would be a balloon payment. There was no notice or reminder of this from Chase. They refused to make any payment arrangements and insisted that I had to let the tow truck take the car unless I had $1,400 in cash at that very moment. The tow truck driver couldn’t even believe that they were taking it either. This is our only car.

Without it my husband could not get to work, my daughter to school, or my son to his multiple therapy appointments. Even after requesting a supervisor, they still refused to work with me. Keep in mind that I would not be responsible for any of the cost and fees associated with repossessing the car, as it was included in bankruptcy and not reaffirmed. Chase would be responsible for all of that. So the car was repossessed and towed away. We had to rent a car to the tune of $234 for the week. I called Chase again first thing Monday morning. I informed them that I would be redeeming the car on that Friday morning when my husband got paid. I was given specific instructions on what to do when I made the payment in cash at the Chase branch. I then called the towing company who took the car and informed them that I would be getting the car on Friday morning. I was told to call Chase back and ask for a redemption hold. I called Chase back and they refused. I called them multiple times that week. At one point I was told a completely different person was now in charge of my account. I was given a completely different set of instructions on making the payment at the bank. I kept in contact with both Chase and the towing company throughout the week.

On Thursday morning, I called the towing company and was informed that my car was in route to Manheim Auto auction almost 4 hours away from my house. I was told that they would bring it back to my city by the next day for $100. On Friday morning, just before going to the bank to redeem the car, the towing company called and told me that my car was at the auto auction and Chase refused to let them bring it back to my city. I called the auto auction and was told that they close early at 3:30 on Fridays and are not open on the weekends at all to pick up the car. I went down to the bank and paid the $1,400 and followed their instructions on having the payment receipt faxed to them. My husband had to leave work early and we drove the 4 hours to pick up the car. It took almost the entire 4 hours and multiple phone calls for Chase to fax the release to the auction in time. I arrived at the auction just before closing, but late for my scheduled appointment. The woman handling this at the auction was quite sympathetic of my situation and effort and happily agreed to let me pick up the car. I was informed that Chase would be billed for over $300 in transport and storage fees from the auction, as well as the repossession and storage costs to the towing company.

So Chase was it worth wasting probably almost $700 to repossess the car? Add on the cost of my rental car and the complete waste of all of my time. And thank you for the wild goose Chase to pick up MY car! And by the way, I still to this day have never received any repossession documents in the mail from your bank and you know where I live. That is against the law! Please remember that according to my state’s laws you must send me notice of release of lienholder within 15 calendar days. It is now day 8. I do expect to receive my title in a timely matter. Chase Bank…I will never forget this experience with you bank and I will never ever do business with you again. I like to remember how much money our government bailed toughie with and this is the thanks you give to hard working families?

The National Credit Union Administration is threatening to sue several large banks, including JPMorgan Chase, seeking the refund on $50 billion in mortgage-backed securities sold to wholesale credit unions, who buy the securities on behalf of retail credit unions. The securities are now worth $25 billion, half of what their original value.

In one of the broadest accusations that Wall Street helped cripple financial institutions during the crisis, the National Credit Union Administration, or NCUA, has threatened to sue several investment banks unless they refund over $50 billion of mortgage-backed securities sold to the five institutions, called wholesale credit unions.

The NCUA is accusing Goldman Sachs Group Inc., Bank of America Corp.’s Merrill Lynch unit, Citigroup Inc. and J.P. Morgan Chase & Co. of misrepresenting the risks of the bonds to wholesale credit unions, which loaded up on the bonds in their role of investing on behalf of retail credit unions, according to people familiar with the situation.

Big banks like Chase are constantly complaining these days for the loss of revenue (profits) associated with new laws that curb (abusive) practices like automatic overdraft protection and debit card swipe fees. They claim that all this new legislation that restricts their ability to make money is forcing them to raise fees on consumers in other ways.

I’m not buying it.

What is reallly happening here is that we have seen two decades of banking innovation. Banking innovation is really just another term for banks discovering new and better ways to bilk their customers for more and more fees. From lending practices that urged customers to borrow beyond their means, to pages of small-print rules that let them jack up the fees and rates when those same customers couldn’t afford to pay (i.e. the bank’s desired outcome). Overdraft “protection” programs that customers didn’t want but got surprised with anyways, credit card and debit card swipe fees that bilked merchants, you name it, banks have added it on over the last two decades any way they could.

The biggest banks were/are the worst and most banks aren’t at all what banks were 20 or more years ago: institutions that served their customers.

Now, the expectation of all this added fee income is a higher level of profitability that has set a new bar.

So of course banks are going to whine about their gravy train going away and look for other ways to get paid more money for providing less and worse service. It makes perfect sense.

Unless you go back and reconsider what a bank is really meant to be. If you did, you’d be leaving your big bank for a smaller one that exemplifies what banks are supposed to be like.

This story clearly shows that Chase has a history defrauding its customers to benefit itself.

NEW YORK, March 7 (Reuters) – JPMorgan Chase & Co (JPM.N) has settled a lawsuit accusing it of defrauding bond investors out of at least $1.2 billion through bad record keeping, court records show.

The settlement of the five-year-old case comes as banks’ ability to handle paperwork faces intense scrutiny, especially over their mortgage operations.

Investors had accused JPMorgan of deleting records on $46.8 billion of bonds from roughly 6,500 bond issues that had not been cashed in, and then covering up its mistakes.

They said the second-largest U.S. bank did this so it could retain for itself unclaimed bond proceeds that belonged to thousands of investors.

JPMorgan “stole the trust funds and concealed the theft long enough to try to run out the statute of limitations,” an amended complaint filed in 2009 said.

If that wasn’t clear enough, Chase is accused of deleting records so that it would be harder for people to claim bond proceeds so Chase could keep any of the proceeds that went unclaimed.

JPMorgan Chase CEO Jamie Dimon is getting a $12 million bonus, in case anyone was wondering where their overdraft fees from carefully managed overdraft generating deposit ordering is going.

Perhaps the $1.8 billion JPMorgan Chase paid for Washington Mutual’s assets wasn’t a bargain after all. They’ve tried to deny responsibility for any of the toxic assets that were sold to others by WaMu but the FDIC pushed back hard on that one.

Today Allstate filed a $787 million lawsuit against Chase for mortgage-backed securities they bought from WaMu.

Allstate sues JPMorgan over mortgage debt losses

By Jonathan Stempel

NEW YORK, Feb 16 (Reuters) – Allstate Corp (ALL.N) sued JPMorgan Chase & Co (JPM.N) on Wednesday to recover losses after the bank allegedly misrepresented the risks on more than $757 million of mortgage securities the insurer bought.

The lawsuit against the second-largest U.S. bank was filed just seven weeks after Allstate filed a similar lawsuit against Bank of America Corp (BAC.N), the largest bank, over losses on more than $700 million of mortgage securities.

Jennifer Zuccarelli, a JPMorgan spokeswoman, declined to comment on the lawsuit, which was filed Wednesday in the New York State Supreme Court in Manhattan.

Allstate, the largest publicly-traded U.S. home and auto insurer, is one of many to sue lenders for allegedly misleading them about mortgage securities.

The Northbrook, Illinois-based company said it suffered “significant losses” after JPMorgan and its affiliates misled it into believing it was buying “highly-rated, safe securities” backed by high-quality loans.

“In fact,” Allstate said, “defendants knew the pool was a toxic mix of loans given to borrowers that could not afford the properties, and thus were highly likely to default.”

Read More …

Ouch!

Information from the latest article in the Wall Street Journal (What J.P. Morgan Knew about Madoff Fraud, 2/17/11) doesn’t look good for JPMorgan Chase.

The article points to an internal formal report on Madoff that raised suspicions and quotes Bernard Madoff implicating the banks complicity in the fraud:

The question over what the banks knew was rekindled Wednesday when Mr. Madoff, in an interview with the New York Times, asserted that banks and hedge funds, which he declined to name, “were complicit” in his fraud.

“They had to know,” he said.

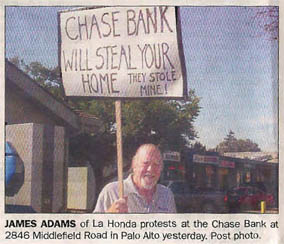

Here is a story from a local paper about a man protesting his foreclosure by Chase Bank.

Homeowner fights bank foreclosure

Daily Post, February 12th, 2011

After picketing outside a Palo Alto Chase Bank yesterday, a man has a second chance at getting his home out of foreclosure.

James Adams, 63, of La Honda. picketed outside the Chase at 2846 Middlefield Road in Midtown Palo Alto at noon yesterday. He also picketed outside the Chase at 2300 Broadway in Redwood City on Wednesday.

His home for decades

Adams told the Post yesterday that he discovered on Dec. 20 that the bank foreclosed on his home of more than 34 years after he worked for months to get a loan modification.

“It’s a real common story – there is a corporate culture of greed and lying,” said Adams.

Falling behind

Adams said he’d been paying the principal interest on his loan, but fell behind on his payments in 2008 because he developed arthritis in his knees. He added that work had also dried up for his woodworking business at about the same time.

Chase called Adams later in the afternoon and gave him a second chance to modify his loan, said Chase spokeswoman Eileen Leveckis. She said it wasn’t because of his protest, adding the bank had been in contact with him since Monday working on the modification.

Did it work?

“Do 1 think my protest had an effect on Chase? You bet!” said Adams in an e-mail to the Post. Nevertheless, Leveckis said there’s hope for Adams with the second loan modification.

This is yet another example where Chase has proven to be media sensitive to its bad acts. Your single best chance in getting Chase to stop whatever bad behavior it is doing, is to get someone in the press to notice. I wouldn’t be surprised if someone inside the Chase branches where Adams was protesting noticed media presence and contacted their superiors.

What if a much larger percentage of people that Chase has abused were to protest like this? I’ll bet it just might actually make abusing customers less profitable for Chase.