Debit cards are at the heart of the battle between consumers and banks. Until the overdraft protection laws from the Credit Card Act of 2009 took affect in August of this year, banks made $38 billion a year in overdraft fee income. Banks can still reap huge rewards from the overdraft income stream by cajoling consumers (like Chase does) into signing up for voluntary debit card overdraft protection, or by allowing ACH transactions linked to debit cards (automatic payments, PayPal money transfers) to go through despite resulting in a negative balance.

An article in the Wall Street Journal today outlines another reason why using your debit card is not a good idea; your exposure to losses related to theft is far inferior to that if your credit card.

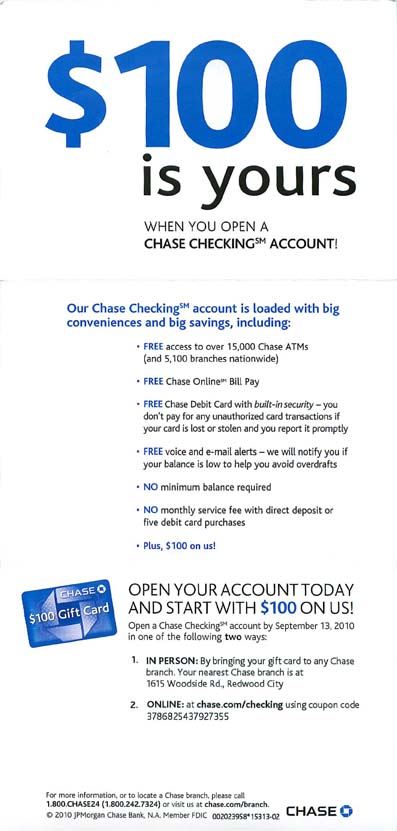

One of the big selling points of debit cards, highlighted in ad campaigns and on bank websites, is that you’ll have “zero liability” for losses if your card is lost or stolen—just like credit cards.

Turns out that’s only sort of true.

In fact, nearly every debit card comes with restrictions in cases of theft. Some banks limit your coverage if you are slow to report a lost card or potential fraud. Some don’t cover fraudulent ATM transactions. Some may require that you show “reasonable care” in protecting your card or PIN number.

The matter is a significant one. There were 38.6 billion debit-card transactions last year, far more than the nearly 23 billion credit-card transactions, according to the Nilson Report newsletter in Carpinteria, Calif. Banks encourage customers to use debit cards, since they are far more lucrative than cash or checks.

The loopholes grow out of different federal regulations for different cards. Under federal law, your losses from unauthorized charges on your credit card are limited to $50, and there is no time limit for when you must report the problem. Many issuers go further, waiving all losses due to unauthorized credit-card use.

Debit cards, by contrast, are covered under a different law, and the rules are much more complex. If you call your bank within two business days of discovering your card is missing, your losses are limited to $50. But if you wait, you could be on the hook for up to $500. And if you don’t report the problem within 60 days after it shows up on a statement, you might face unlimited losses.

In the late 1990s, and went beyond those requirements, promising reduced liability for their branded debit cards. But there are several loopholes: Visa’s “zero-liability policy” doesn’t cover ATM transactions, some business cards or PIN transactions that don’t go through the Visa network. It does cover transactions where you sign, which bring in more revenue than PIN transactions.

MasterCard doesn’t cover any transactions that require a PIN, and it won’t cover more than two theft events in a 12-month period. You must also exercise “reasonable care” to prevent your card from being misused. But that term is subject to interpretation. Have you failed to show reasonable care if you forget your card at a restaurant? That depends on the circumstances and your bank, a spokeswoman says.

Read more …

It is very easy for a bank to simply claim that you didn’t use sufficient care in protecting your debit card, or that there is no evidence of fraud (i.e. they accuse you of falsely calling a transaction you did as fraud), sometimes despite evidence that you were thousands of miles away.

Overall, you are better off using a credit card for transactions that you want to do electronically and then paying the bill off in full every month.