Given some of the excessive harassment (which is illegal) that Chase has been accused of for some people in arrears on their loans, it is somewhat surprising that in this case they didn’t exhaustively attempt to get a response from the borrower for a loan months behind in payment. But of course that is easily explained by the fact that Chase’s overall corporate demeanor seems to be split between being the bad buy and some serious ineptness.

Incidentally, despite the fact that this article starts out talking about Washington Mutual, the time frame puts the ownership solely in Chase’s hands, as this story began more than 8 months after Chase acquired WaMu.

Hans and Marina Oosterveen were in for a rude awakening the summer of 2009 when they arrived at one of the two houses they own in Haines City. Posted was a for sale sign, plus the locks had been changed. What they learned when the spoke to the real estate agent left them in shock. They had been foreclosed.

“There was a property manager who was supposed to pay the bills: utilities, insurance, taxes, mortgage, who decided to pocket the money,” said Stanz.

Yet the couple was says it was totally unaware anything was amiss. That was because they never received any notification from the mortgage holder, Washington Mutual, which was eventually seized by the federal government. Stanz placed the responsibility solely on Washington Mutual. Once monthly mortgage payments ceased being paid, it began sending notices to the Oosterveen. The problem was, the notices were going to the Haines City addresses, not the address in The Netherlands, which Stanz said the bank was fully aware was the permanent residence.

I had this happen with Countrywide Home Loans once. I had just switched to their electronic only bill service and expected it to work like paper bills, where you get an email telling you the bill is ready. Countrywide however didn’t send such an email and expected you to download the bill on your own volition. When I didn’t get notification of a bill and as a result didn’t make a mortgage payment, Countrywide called our rarely used home number over and over again for two weeks while we were on vacation, despite the fact that they had my cell phone number and email address.

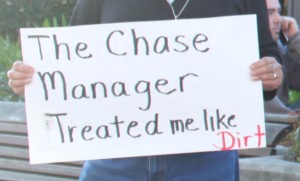

When something as big as foreclosure is at stake, it is simply inexcusable that the bank didn’t exhaust all possible ways to communicate with the borrowers. Of course the story goes on with Chase being the bad boy and making it really hard for the homeowners to rectify the situation.

“They told my clients they wanted $39,000 within five days, no ifs, ands or buts,” said Stanz, who challenged the deadline. He needed time to review the charges and fees. While there were legitimate fees, there were also “junk fees” that tacked on additional, costs, which he challenged and was successful in getting the majority removed.

He urged his client to err on the side of caution and recommended they overpay which the Oosterveens did to the tune of $41,000. But even doing that did not result in the account being brought current.

“I wrote four to five letters, a letter each week, asking for proof of reinstatement of the loan,” said Stanz. To no avail.

Banking should be about relationships. Is this really the way you want to related to your bank?